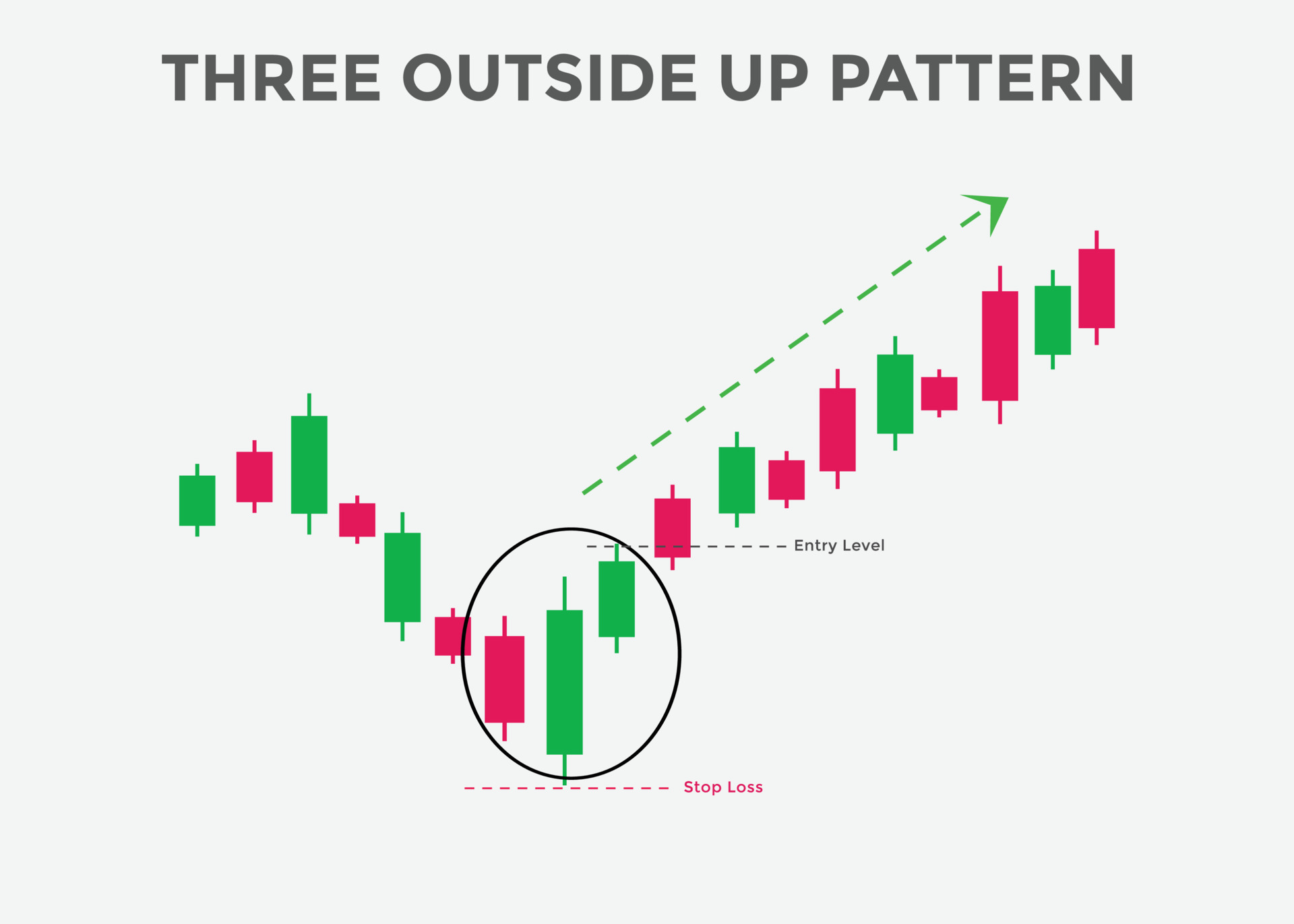

Three outside up candlestick pattern. Candlestick chart Pattern For Traders. Powerful bullish

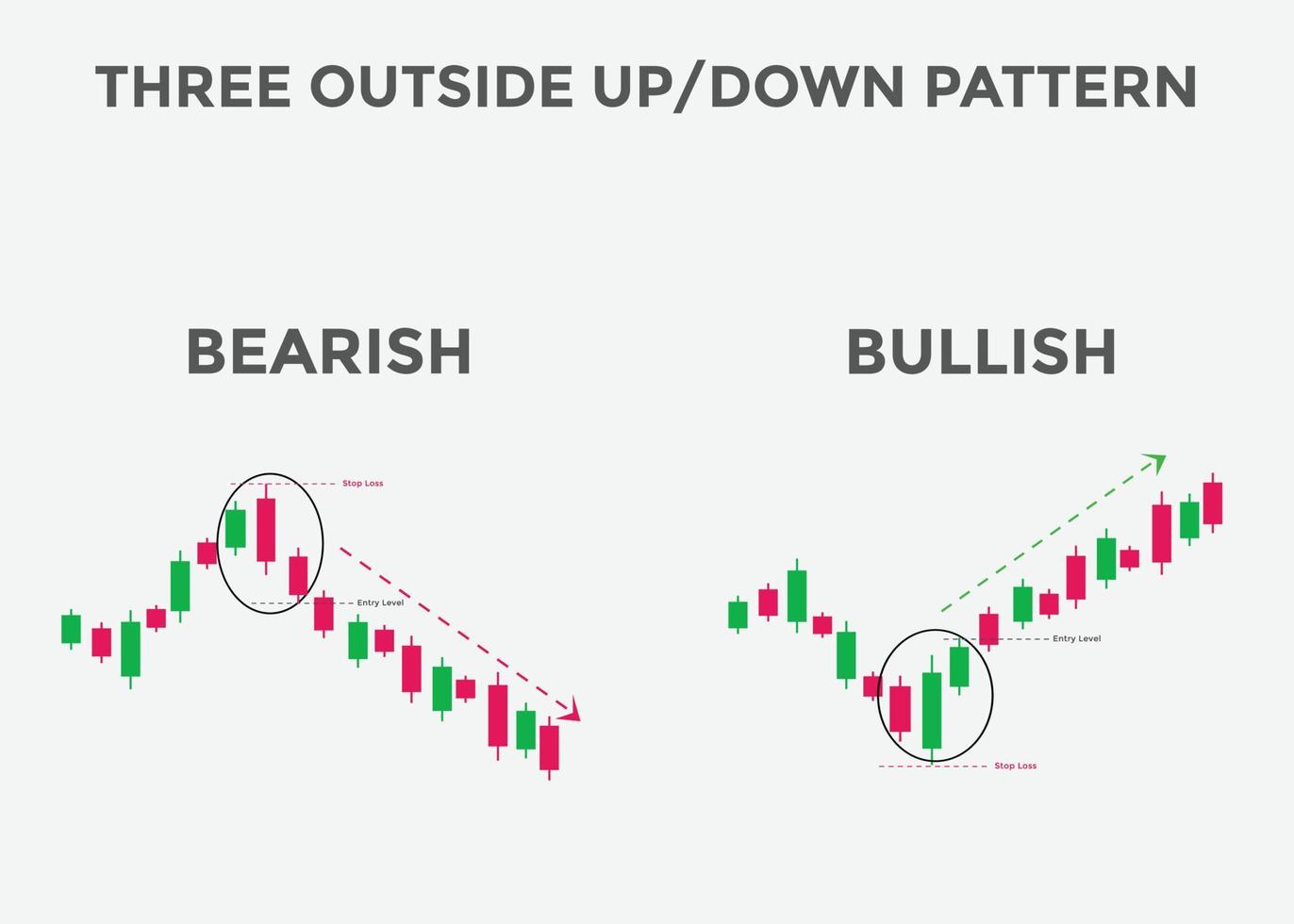

Three outside up/down are patterns of three candlesticks that often signal a reversal in trend. The three outside up and three outside down patterns are characterized by one.

Three Outside Down Bearish Candlestick Pattern ForexBee

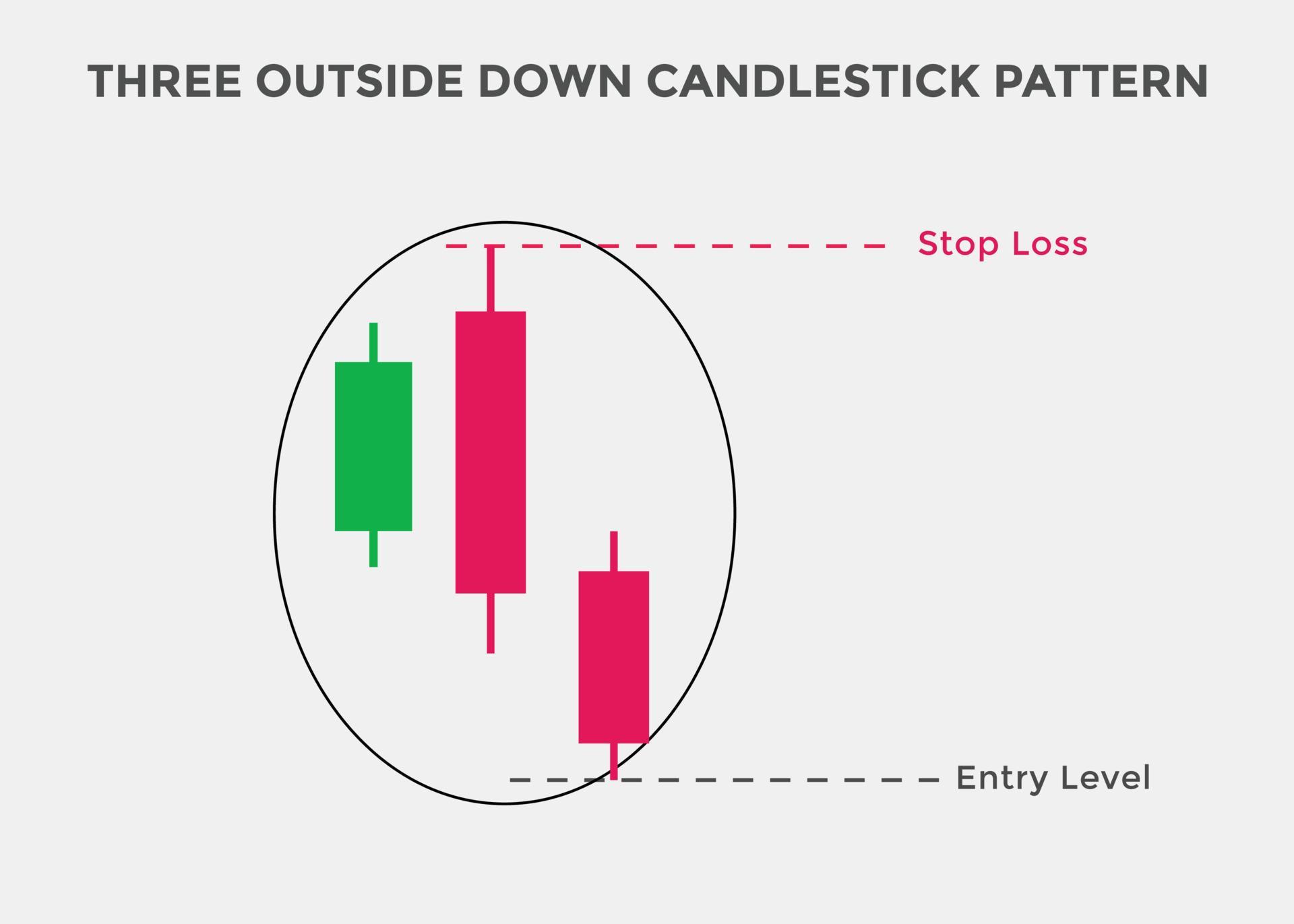

The Three Outside Down is a bearish reversal pattern that emerges on candlestick charts. This pattern, characterized by three specific candles, is indicative of a weakening existing trend and potentially a trend reversal.. The Three Outside Down pattern is a powerful tool for predicting potential bearish reversals. Understanding its.

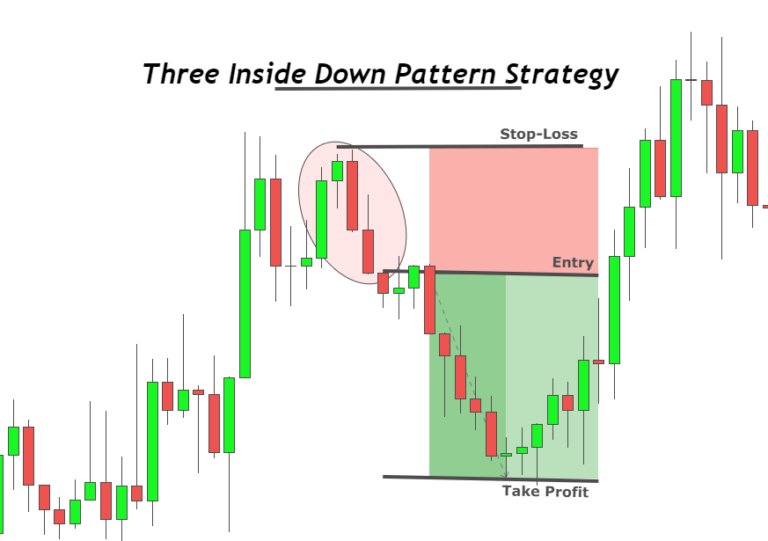

Three Inside Down Candlestick Pattern Bearish Candlestick Patterns

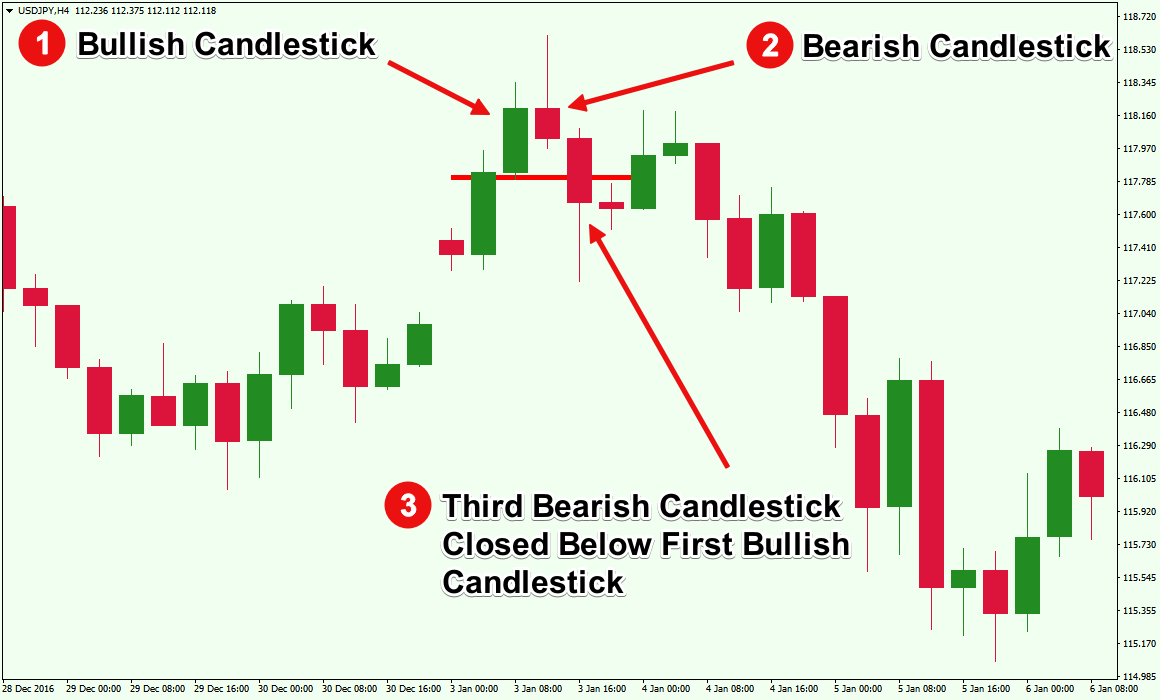

Three Outside Down is a bearish trend reversal candlestick pattern consisting of three candles. The first two candles of this candlestick pattern form bearish Engulfing. The Three Outside Down candlestick pattern is recognized if: The first candle is bullish and continues the uptrend;

Three Outside Up Candlestick Pattern With Trading Strategy

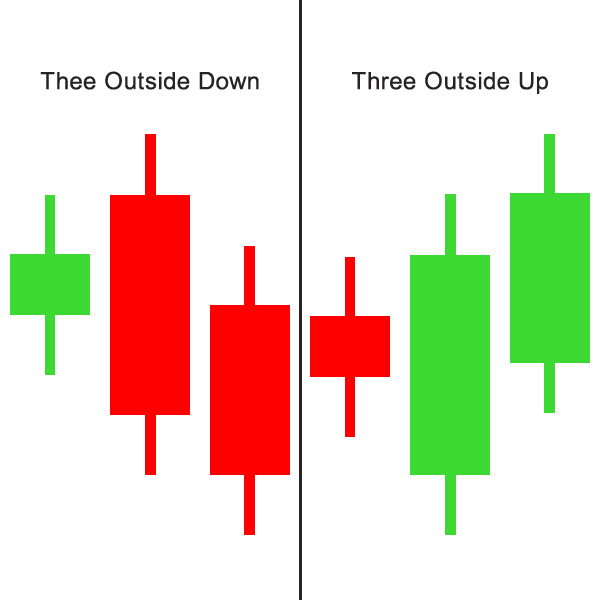

Three Outside Down: The Three Outside Down is a multiple candlestick pattern formed after an uptrend indicating bearish reversal. It consists of three candlesticks, the first being a short bullish candle, the second candlestick being a large bearish candle which should cover the first candlestick.

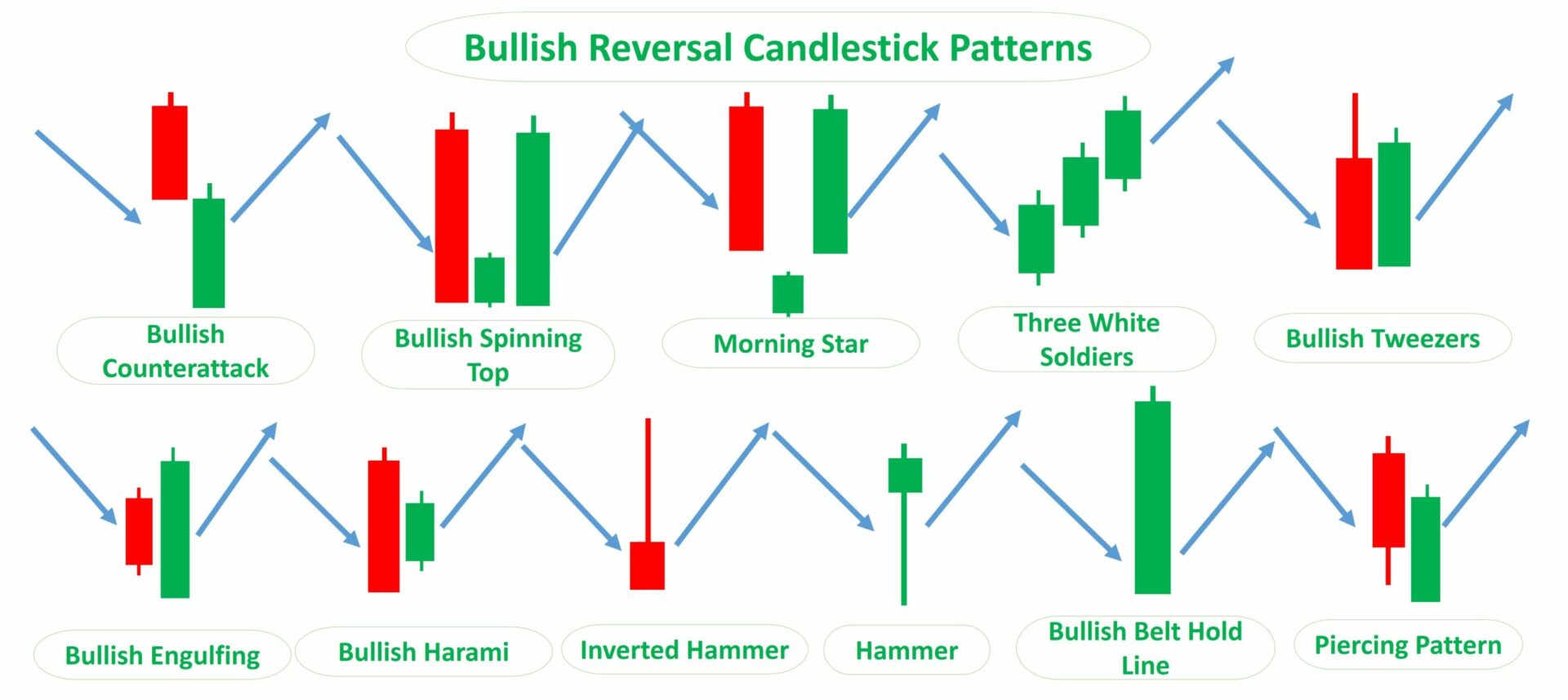

Top Reversal Candlestick Patterns

Three Outside Down is a bearish trend reversal candlestick pattern consisting of three candles. The first two candles of this candlestick pattern form bearish Engulfing. The Three Outside Down candlestick pattern is recognized if: The first candle is bullish and continues the uptrend;

Three outside down candlestick pattern. Candlestick chart Pattern For Traders. Powerful bearish

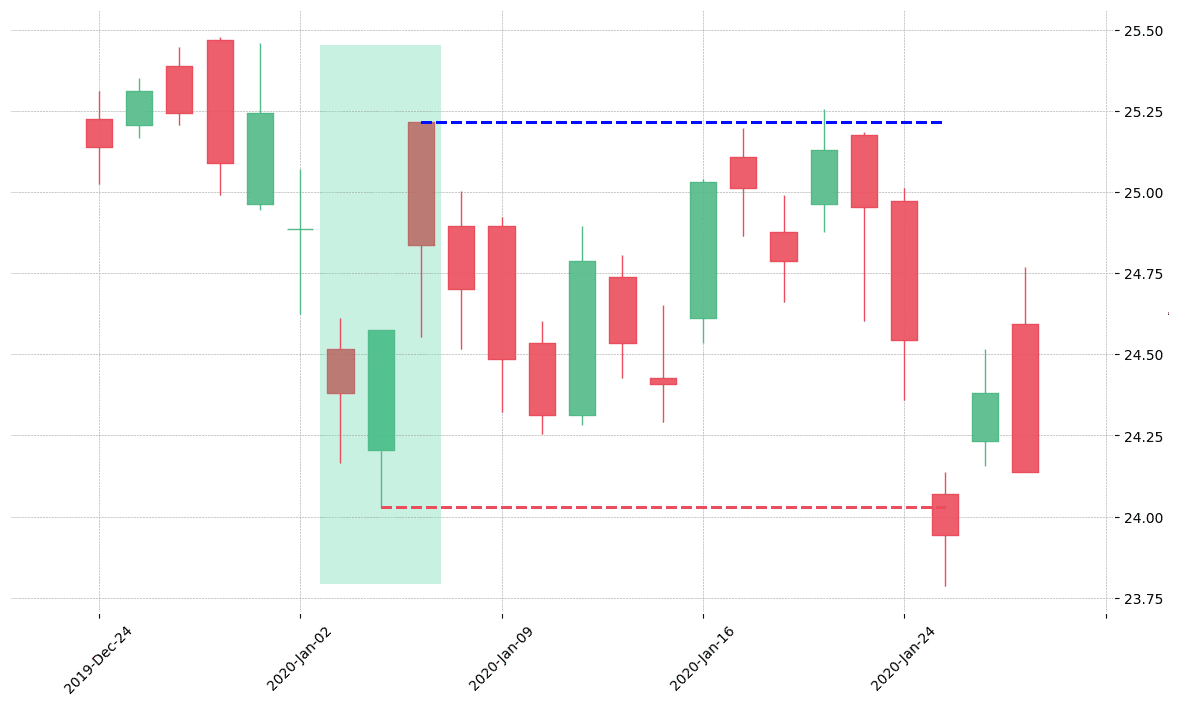

Three Outside Down See our Patterns Dictionary for other patterns. Check our CandleScanner software and start trading candlestick patterns! Figure 1. Three Outside Down pattern. Forecast: bearish reversal Trend prior to the pattern: uptrend Opposite pattern: Three Outside Up See also: Bearish Engulfing Construction: First candle

Three Outside Down

The Three Outside Up pattern is a three-line pattern being an extension of the two-line Bullish Engulfing pattern. The pattern was introduced by Morris, and his intention was to improve the two-line pattern performance. The third candle is meant to behave as a confirmation of the Bullish Engulfing.

What Are Three Outside Up & Down Candlestick Patterns? ELM

1. The market must decline for a three outside up pattern to appear. 2. The pattern's first candle will be black, signifying a downward trend. 3. A large white candle will be formed next. It will be long enough for the first black candle to be completely contained within its true body.

What Are Three Outside Up & Down Candlestick Patterns? ELM

The Three Outside Down is a Japanese candlestick pattern. It's a bearish reversal pattern. Usually, it appears after a price move to the upside and shows rejection from higher prices. The pattern is bearish because we expect to have a bear move after the Three Outside Down appears at the right location.

An Overview of Triple Candlestick Patterns Forex Training Group

The three outside down pattern generally occurs during a bullish trend and involves three consecutive candlesticks. The movement of these candles invariably indicate whether a trend reversal is on the cards or not. The pattern is characterised by a single bullish candle, followed by two bearish candles.

How To Trade Blog What Is Three Inside Down Candlestick Pattern? Meaning And How To Use It

The three outside down candle pattern is a three-bar bearish reversal pattern. The pattern gets its name from its appearance on a candlestick chart—three candles, with the second being outside the first and the last moving down. Traders consider the pattern a bearish trend reversal, but history shows that volatility usually comes first.

Reversal Three Inside Outside Up and Down Candlestick Pattern Best Forex Brokers For

In this video:we dive deep into the Three Outside Down Candlestick pattern trading strategy. Unlocking the secrets of this powerful pattern you will learn ho.

Three Outside down candlestick pattern PDF Guide Trading PDF

The Three Outside Down trading pattern is a candlestick pattern that forms over three consecutive trading sessions. It is a bearish reversal pattern that consists of three candlesticks and is typically formed at the end of an uptrend or an extended price rally in a downtrend, where it may signal a potential price reversal to the downside.

Three Outside Up & Down Candlestick Pattern PatternsWizard

The Three Outside Down Candlestick pattern typically occurs during an uptrend when the market has been experiencing bullish price action but it can also occur after a period of consolidation or sideways trading. The three outside down candlestick pattern occurs when there is a shift in market sentiment from bullish to bearish. The three outside.

Trading Patterns Including Three Candlesticks

The three outside down candlestick pattern is a valuable tool for traders and investors to identify potential bearish reversals in the market. This pattern, composed of three consecutive candlesticks, typically forms at the end of an uptrend or during an extended price rally in a downtrend.

Three outside up and down candlestick pattern. Candlestick chart Pattern For Traders. Powerful

A three outside down pattern consists of four candlesticks that form near resistance levels. The first candle is bullish, the second is a bigger bearish candle that forms a bearish engulfing, and the other two candles form lower highs. Typically, the fourth candle forms a bearish reversal pattern.